Why Do Expenses Per Mile Matter?

Ever heard the old saying…

How do you eat an elephant?

How do you eat an elephant?

One bite at a time.

Big problems are supposed to be solved with easy, simple steps. Break the problem down and do the next thing, then the next thing, and then the thing after that.

Ok, that makes sense. But what does that have to do with expenses per mile?

It’s the same thing, but in a bad way.

One cup of coffee here, two donuts there, an unexpected detour that forces you to take a longer route… and suddenly your expenses have grown without you even noticing it.

The big expenses:

- insurance for your rig

- plates

- scale tickets

- tolls

- IRP

- IFTA

- HVUT

That’s just the short list.

Your food costs don’t matter so much in expenses per mile. But there are other things you have to consider.

- Unexpected route changes: The detour adds another 25 miles to the trip. The toll costs on I-80 across Ohio and Indiana. What was a good price per mile for a load quickly loses value when unexpected things like poor road conditions that slow you down.

- On the road maintenance purchases: Buying a new set of wiper blades is a comparatively little expense that no trucker would begrudge. Buying another set of tires on the road because they weren’t taken care of – another matter entirely.

- Fuel purchases: Finding the best price for fuel is one thing that every driver wants – but is skipping an entire state and ending up with a big IFTA bill a good choice?

Does a Blowout Blow Out Your Profit?

I can’t count how many times I’ve heard truckers complain that a tire blowout on the road ruined the profit of the load they were carrying. That’s not how it works. A trucker has hauled loads thousands of miles on those tires. Complaining that the flats have wrecked the revenues for the load ignores the months or years that they rode on those tires. It’s a complicated accounting practice, but it’s called

depreciation. Things that wear out – like tires or clutches – have to be considered an expense over time, not just applied to that one trip when they failed. It might look like the expenses for this load are all out of whack, but when you understand your expenses per mile, it makes some sense.

Why Should I Figure Out My Expenses Per Mile?

There’s a formula to figure out how to compute your expenses per mile. But if you’re using spreadsheets like Google Sheets or Excell, it won’t be easy to figure out. When I used spreadsheets, my expenses were put in a different file than my income and my fuel costs were someplace else because they had to go on the invoice… When I was asked if I was making money, I couldn’t really answer clearly.

Expenses per mile are the critical number every trucker has to know.

I think that if a trucker doesn’t know his or her expense per mile, then how can they know the minimum they should be looking for when they are on a load board? How can they take the risk of taking a load down to Florida or west Texas where getting freight out is always a big risk?

I know plenty of drivers who only want $3.00 per mile for loads. I can’t blame them – everyone wants a load like that. The problem is that I don’t find those loads very often. I might find a load to Florida for $3.00 per mile and think it’s my lucky day, but once I’m down there, I can’t find a single load out that’s over $1.25 per mile. Is it worth it to take a load that pays that poorly? Maybe not, if it’s taking me someplace else where I’m not likely to find a load at a reasonable price.

How can I know unless I know what it costs for me to drive a mile?

The only way for me to understand that I didn’t take a loss when tires blow or the clutch gives out is to have a complete record of my expenses. How complete?

Very complete. Coffee? Probably. Hotel expenses? Absolutely. Chewing gum… well…

When I put all of my expenses into TruckingOffice trucking management software, then I have a complete picture of how much it costs me to run my rig. I don’t have to sort through spreadsheets. I don’t have to copy numbers onto a pad of paper and add them up and then divide by… (Isn’t this why we use computers? To do this kind of work?)

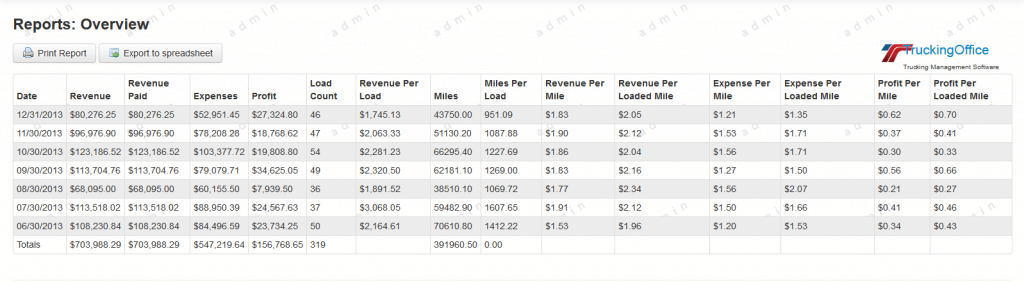

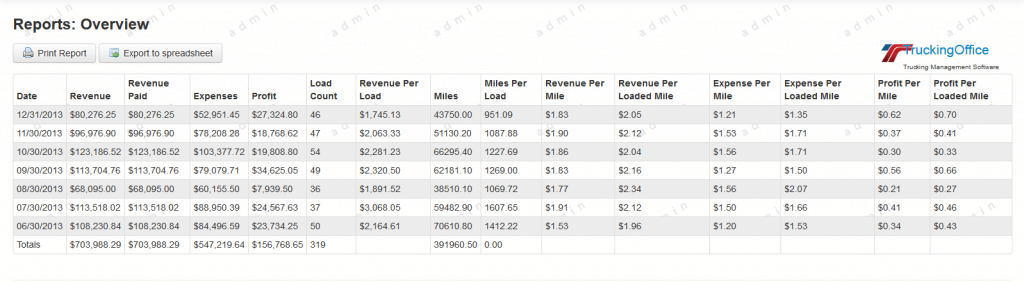

TruckingOffice offers a single report that will allow you to set the dates you want to consider and give you the Company Overview Report.

Company Overview Report

The Company Overview Report collects all the data – all your dispatches, expenses, payments – and uses that data to present you with a simple report that might just change your business forever. You think I’m being a bit dramatic? I don’t think so. When I learned what my expenses per mile were,

I started to understand why I wasn’t more successful and what I had to change to make more money.

Like those truckers who feel that a blown tire ruins their revenue, it’s possible to look at expenses per load. That distorts the true image of how the business is doing because it’s based on too little data. By looking at a larger period of time – like a month – you can get a better view of how business is doing as a whole when a repair isn’t making your bottom line look like it’s an outline of Florida. When you add a month’s data together, you can see a bigger picture. You’ll know what a good rate is, what’s the minimum you need to make a profit, and when you maybe should pass on a load instead of taking it just to get out of Florida.

When I saw that I was taking bad loads that were convenient, or were long so I didn’t think the price per mile was a big problem – I understood what had to change.

That’s why you need to know your expenses per mile.

How can you find your expenses per mile? I recommend

trying TruckingOffice free of charge. Put in your dispatches and your expenses for the past month and add in this month’s – and see what you can discover about your trucking business.

How do you eat an elephant?

One bite at a time.

Big problems are supposed to be solved with easy, simple steps. Break the problem down and do the next thing, then the next thing, and then the thing after that.

Ok, that makes sense. But what does that have to do with expenses per mile?

It’s the same thing, but in a bad way.

One cup of coffee here, two donuts there, an unexpected detour that forces you to take a longer route… and suddenly your expenses have grown without you even noticing it.

How do you eat an elephant?

One bite at a time.

Big problems are supposed to be solved with easy, simple steps. Break the problem down and do the next thing, then the next thing, and then the thing after that.

Ok, that makes sense. But what does that have to do with expenses per mile?

It’s the same thing, but in a bad way.

One cup of coffee here, two donuts there, an unexpected detour that forces you to take a longer route… and suddenly your expenses have grown without you even noticing it.

Like those truckers who feel that a blown tire ruins their revenue, it’s possible to look at expenses per load. That distorts the true image of how the business is doing because it’s based on too little data. By looking at a larger period of time – like a month – you can get a better view of how business is doing as a whole when a repair isn’t making your bottom line look like it’s an outline of Florida. When you add a month’s data together, you can see a bigger picture. You’ll know what a good rate is, what’s the minimum you need to make a profit, and when you maybe should pass on a load instead of taking it just to get out of Florida.

When I saw that I was taking bad loads that were convenient, or were long so I didn’t think the price per mile was a big problem – I understood what had to change.

That’s why you need to know your expenses per mile.

How can you find your expenses per mile? I recommend trying TruckingOffice free of charge. Put in your dispatches and your expenses for the past month and add in this month’s – and see what you can discover about your trucking business.

Like those truckers who feel that a blown tire ruins their revenue, it’s possible to look at expenses per load. That distorts the true image of how the business is doing because it’s based on too little data. By looking at a larger period of time – like a month – you can get a better view of how business is doing as a whole when a repair isn’t making your bottom line look like it’s an outline of Florida. When you add a month’s data together, you can see a bigger picture. You’ll know what a good rate is, what’s the minimum you need to make a profit, and when you maybe should pass on a load instead of taking it just to get out of Florida.

When I saw that I was taking bad loads that were convenient, or were long so I didn’t think the price per mile was a big problem – I understood what had to change.

That’s why you need to know your expenses per mile.

How can you find your expenses per mile? I recommend trying TruckingOffice free of charge. Put in your dispatches and your expenses for the past month and add in this month’s – and see what you can discover about your trucking business.

Trackbacks/Pingbacks