When a contract for a dedicated route (or lane) is made, both the shipper and the trucker get a good deal. Some shippers do not want to depend on load boards because they want to know the trucker who is hauling the freight. The trucker has to appreciate a regular load to be able to count on. But there can be one big problem in this relationship: the cost of fuel. That’s why all long-term shipping contracts should include a fuel surcharge clause.

Can You Predict the Cost of Fuel?

If you can predict the cost of fuel next year, or even next month, the the fuel charges wouldn’t be necessary. You’d just bill what you know the fuel costs will be. But we can’t know. We can barely predict what the cost will be tomorrow. So signing a contract that doesn’t protect the trucker from the erratic changes in the costs of fuel is asking for trouble – or bankruptcy.

A clause to adjust fuel surcharges in long term contracts protects all parties.

- The shipper gets a regular trucker to handle their loads, regardless of the changes in the cost of fuel. If the price of fuel were to go too high for the trucker to make a profit from the load, why would the trucker haul it?

- The trucker is protected against inflation. The cost of fuel varies across the country, much less across the month. Who would risk bidding on a contract that doesn’t provide for the fuel costs variability?

- As a fleet manager, fuel surcharges on long term contracts protect your business. You maintain a good and professional relationship with your truckers as well as keeping the shipper happy means managing the costs versus the needs of the shipper.

Computing the Base Rate

One thing that most truckers don’t understand about fuel surcharges in long term contracts is that it’s not about paying for the entire fuel costs.

The initial bid for the contract should include all of the costs a trucker or a fleet manager would figure into a one-time load. The fuel surcharge not designed to pay for fuel, just to adjust for price changes. The current cost of fuel should be included in bid.

The fuel cost surcharges are based on one of two methods:

- Percentage based OR

- per mile based changes

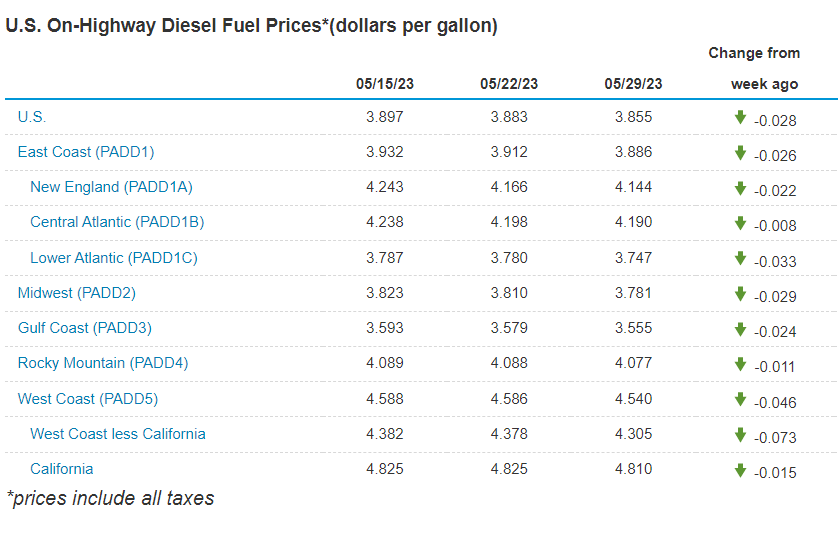

The formula for either method should be spelled out in the contract. Ideally, the fuel price isn’t based on the shipper’s home state or the trucker’s best guess on the roads. The US government publishes weekly the Gasoline and Diesel Fuel Update for independent data verification.

Using the page, the cost of fuel is clear to all parties. The formula – whichever one is picked – uses numbers that both parties agree to.

What’s the Fuel Surcharge Formula?

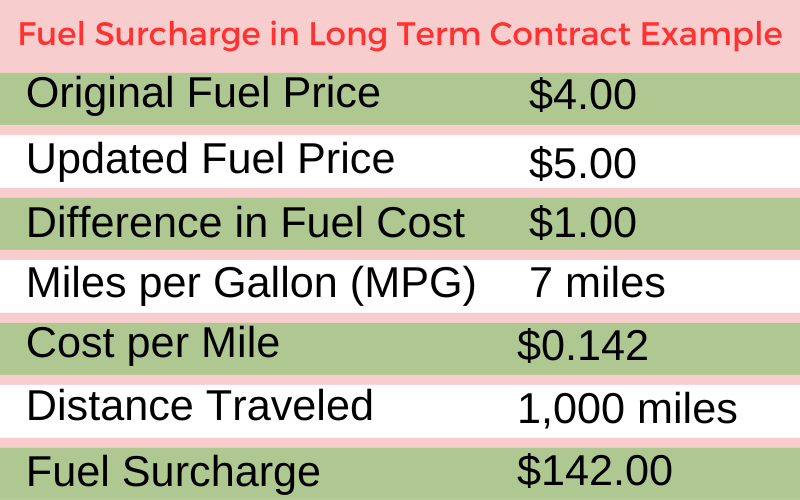

When a contract is signed, the parties agree to a base price to haul the load. The fuel surcharge formula may be the difference between the cost of fuel at the time of the contract and the cost of fuel at the time of the shipment. If the cost of fuel is $3.00 per gallon, and the costs go up a year later to $4.00 per gallon, then the price difference is $1.00

So how to figure out the formula?

It can be as simple as multiplying the miles traveled by the difference in the price per mile in fuel.

Since this applies to a recurring lane, it’s easy to know what the mileage should be. The difference in the fuel cost, divided by the miles per gallon equals the cost per mile. Then the cost per mile is multiplied by the distance traveled.

Real numbers, please

You got it. I like round numbers, so here we go.

Whatever formula the shipper and the trucker agree to, that’s the formula to use.

Invoicing Fuel Surcharges

Whatever you do, make sure that fuel surcharge shows up on your invoice! In TruckingOffice PRO, we make it easy for that charge to be added to your invoices. So you can get paid quickly, you can create and send an invoice while you’re still the yard, waiting for the crew to pull that load off your trailer.

TruckingOffice PRO is the tool you need to run your trucking business, regardless of the season or how crazy the trucking industry gets. In times when we see rates skyrocket and then drop lower than they’ve been in years, you need the tools to help your trucking business survive and grow.

Choose a trucking software that fits your business

If you have a small fleet – and most of us do, based on the statistics – you don’t need the big ticket high cost trucking software packages that are on the market now. What you do need is a software designed for the small trucking firms and independent owner operators. That’s TruckingOffice PRO.

We’ve got you covered with

- accounting system that manages trucking invoices. Not QuickBooks. Not any other standard accounting program. We need a system that understands mileage to compute IFTA and IRP in seconds, not hours

- dispatching program that uses PC*Miler to compute miles on a route that’s truck safe (Does Google Maps even have that option?)

- maintenance records and scheduling that’s DOT compliant in case of an audit (and saves you money to prevent the emergency repairs.)

That’s not all TruckingOffice PRO provides. Take a free trial of our software to discover how you can build your trucking business. Sign up today!

Recent Comments