When I started my trucking career as an owner/operator, I worked on the accounting system that made sense to me. If the money was in my bank, then I was good. I never counted my billable income until it was in my pocket. This is called the Cash Accounting Method.

When I was working for myself, by myself, that worked – except I never knew how well I was doing. Was I making enough money on a load? What did my revenue stream look like?

In November, I’d be running my max – all the miles and hours I could. Come January, I’d be flush with cash – when I was only driving half the miles and even fewer days. Then in March, my business would be picking up again – and I didn’t have the money to pay for my fuel. If someone paid me late – I was stuck.

Once I got several trucks going, it got worse, trying to track the billables and figure out if I was making money when I didn’t get paid for a lane for two months, but I had to pay my driver settlements now.

Managing my business forced me to go to the traditional accounting methods, which is called the accrual method. I had a hard time making the change, but I found that these methods helped me to discover just how my business was doing.

The big problem with the cash accounting method is you can’t tell how you’re doing on a monthly basis. If you drive this month, but don’t get paid until two months later, it looks like you made the money then. Some loads are good, some not so good. How do you know if you’re doing well overall? How can you tell if you’re making the right bid on a load? If your truck is in the shop for a week, the cost isn’t just how much the repair cost, but also the lost income from the loads that were missed. How does an owner/operator keep track of the money flow?

Accounting for Trucking Businesses

Accrual accounting keeps track of work and pay in the same month, not separate months. The system tracks money based on when it is earned, not when it is paid, making it simple to compare the month’s income against the month’s expenses. When you can compute the month’s income against the expenses and income, then it’s easy to see if the loads are making money. If there are LTL loads, this becomes even more important.

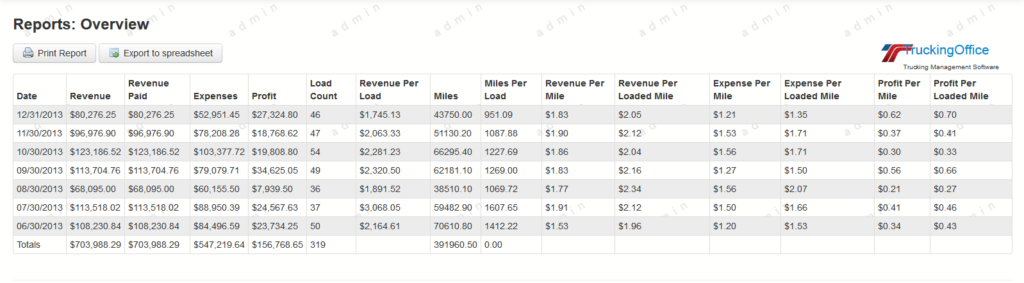

This is why TruckingOffice and TruckingOffice Pro both use the accrual accounting system. Our program will take your load information in our One Minute Per Entry dispatch entry system and all those important calculations are done automatically – just like your invoices and IFTA report can be done. We have reports that will tell you at the press of a button how well you’re doing.

TruckingOffice provides an overview of your finances in one easy page – no extra work required to see how your profits add up. Enter your loads and see the reports that can make you profitable.

Once you start using the accrual method, then you can create the statistics that show you the picture of how your business is doing. These reports are impossible to create with the cash method, but the information is critical to your success. Revenue per mile, expenses per mile, profit per mile, those are basic numbers to determine how a truck business makes money.

If you’re ready to make sure you’re making money now and in the future – TruckingOffice and TruckingOffice Pro (with LTL capabilities) are here to help. We’ll give youa month free for you to discover what you’re doing right – and how to fix what you’re doing wrong.

Recent Comments