As an owner operator, you’re responsible for all of your paperwork and compliance to all the laws. I found I could get snowed under really quickly if I didn’t take care of my paperwork. If I didn’t do it after every load, I at least had to do it every Saturday.

Most trucking companies give the drivers a Trip Pack Envelope. All the paperwork I needed would be in there, and all the papers – receipts, bills of lading, toll receipts – would go back into the envelope to be turned in when I got back to the office.

Going at it on my own, I tried to do the same thing. I would keep all my papers in one envelope and try to update my spreadsheets and file the receipts in my closet. I thought it was better than using a shoe box.

But it could get away from me way too easily. If I didn’t take the time on Saturdays, if I blew it off until “next week” – I’d be in a lot of trouble. When the Department of Transportation called me in for a compliance review, I could have been in a lot of trouble if I still used that method.

So what should owner operators do to keep organized?

1. Know what you need to know.

When I talk to new truckers, I wonder how they learn what they need to keep track of. Some things seem pretty obvious – fuel and toll receipts, bills of lading. But there are a few things that truckers have to track – like time on the road or when you last bought tires – that aren’t so clear. If you use a fuel card, some of the information you’ll need for your records is there – but not all of it. When it comes to accounting, I sometimes feel like the trailer – not the driver. When I switched over to a new accounting system from the cash system I’d always used, I was confused and frustrated.

No one decides to become a trucker so they can keep track of all the numbers and accounting, but it’s as important as getting your shipments to the consignees on time. Take some time to talk to an accountant who knows trucking. Even if you don’t think you can afford a monthly bookkeeping service right now, paying for that consultation may save you hours of headaches and dread if the government comes calling.

2. Keep the supporting documentation in good order.

I might be called to pull receipts from three months ago for a review by the DOT, but in the case of an IRS audit, they can require materials that are up to seven years old. If you’re using some sort of online system for tax preparing, then if should have the option to pull up past tax information. Label the files you create with the month and year to make it simple to recall those little pieces of paper when you need them to support your driver’s logbooks.

Log books must be kept at least 6 months. After that, I think it’s safest to put them away where you could get them again, but you don’t need them cluttering up your office. Box them up, get them out and put them away.

3. Computer records need to work for you, not against you.

I got sick and stuck in the hospital several years ago and my father came out to help me with the business. I tried to explain things but the organization in my head didn’t make any sense to him. I couldn’t explain it. I could do it – and I did. From my hospital bed, I tried to run my trucking business.

My father is a computer programmer. He works with data all the time, and he was right about the system I’d built using spreadsheets and a basic accounting program – I was working much harder than I needed. I had different spreadsheets for everything – but trying to figure out basic things, like if I was making money – was complicated.

That’s how we came to develop TruckingOffice trucking management software.

When it comes right down to it, the same information is used to compute

- profits

- expenses

- driver settlements

- IFTA reports

- IRP reports

- maintenance.

My dad took the time to understand what I needed as a fleet manager – and that’s exactly what any owner operator needs to know: expenses, income, and how to make the computer data work for me. Now I enter my trucks’ loads into TruckingOffice. The program does the work – not me.

It’s crazy not to make this part of being a trucker as fast and simple as possible.

You didn’t decide to be an accountant,

you didn’t decide to be a computer data entry person,

you decided to be a trucker.

That’s why we’ve make TruckingOffice as easy to learn and use as we could. Take all of lasts week’s loads and enter it into our One Minute Per Load form and see what you’ll learn about your business and how to organize it to make it better.

Try TruckingOffice for a month for free. We’ve got people ready to help you get started today.

What organization tips do you have to share with other owner operators?

I am excited to look into this. As a trucker’s wife, I came from education to a pile of papers I do not know what to do with!

Hello!

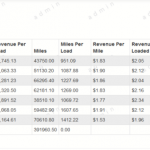

We are an invoicing system that helps you stay organized. Once you enter your trips into the system, there are 15 reports on the right side of the dashboard page that you can automatically generate from that. For instance, you can generate profit and loss reports, unit revenue, IFTA, driver settlements, create invoices, expenses and maintenance reports, etc.

Feel free to start a 30 day free trial at truckingoffice.com. There’s no obligation! If you have any questions or need assistance, please feel free to give us a call at 1(800)253-9647. We are available Monday-Friday from 9AM-5PM Eastern time. We are happy to assist!

If I wanted to make a binder for each of my trucks what tabs should I make? Fuel receipts, miles etc

Thanks for a clear and honest explanation of the nature of this critical and essential service to our nations economy from the perspective of those who are doing the service namely the Drivers and Independent operators!!

I look forward to speaking with your entity (Truckingoffice.com) in the coming week.

Sincerely hugh haywood